Bellwether Properties, LLC, (“Bellwether”) owned property encumbered by a 10’ utility easement owned by Duke Energy, Indiana (“Duke”). Duke owned a ... Read More

FBI Investigates Sexual Abuse Claims Within New Orleans Catholic Church

By: Shaunestte Terrell, Attorney News of a federal investigation into sexual abuse claims within the Catholic Church in New Orleans has gained ... Read More

Sexual Assault: How the Burden of Proof in a Criminal Prosecution Can Affect a Civil Lawsuit

By: Amina A. Thomas, Attorney The New York Times’ Monday morning headline this week was a report on How Rape Cases Get Dropped. The article ... Read More

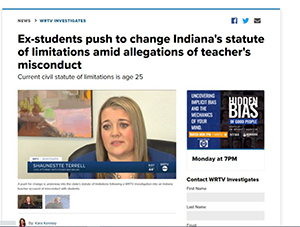

Sexual Abuse in Indiana Schools

VIDEO: A discussion with attorney Shaunestte Terrell Talk with Shaunestte Learn more about how Cohen & Malad, LLP's sexual abuse litigation ... Read More

Sexual Assault Statutes of Limitations: Archaic, Arbitrary, Absurd Deadlines

By: Shaunestte Terrell, Attorney Anyone who’s ever taken in an episode of Law & Order (or even Night Court back in the day) has heard that ... Read More

5 Reasons You Should Consider a Premarital Agreement

By: Nicole Makris, Attorney When marriage is on the horizon, the discussion of a premarital agreement can be an important step in planning for the ... Read More